Technology has completely renewed how business is being operated on a global scale and how employees work. Our smartphones, tablets, laptops, and SaaS tools have given rise to digital workspaces, remote working, and a complete digital transformation, allowing teams to work more efficiently.

Virtual Data Rooms or VDRs are a part of this technological revolution and have completely remodeled how businesses make deals these days. In this blog post, we are going to dive into virtual data rooms- what are they, why are they important, what are its important use cases. Excited? Read on…

What are Virtual Data Rooms or VDRs?

As the name implies, a virtual data room, or a “VDR,” is an online repository where companies store their important and confidential documents and other data. Companies use virtual data rooms in case of a financial transaction or while dealing with a third party.

VDRs are basically cloud-storage services made specifically for sharing private information with clients, partners, or other businesses. They are usually made use of during mergers and/acquisitions to share, review, and disclose company documentation for conducting due diligence.

VDRs are basically cloud-storage services made specifically for sharing private information with clients, partners, or other businesses. They are usually made use of during mergers and/acquisitions to share, review, and disclose company documentation for conducting due diligence.

What’s inside a Virtual Data Room?

A virtual data room is a host to a multitude of documents and files, all of which contain sensitive corporate data that companies want to keep private. Data regarding financial records, tax receipts, legal issues, etc is usually stored in virtual data rooms to keep them safe and secure.

Moreover, documents like trade secrets, competitive info, copyright certificates, details relating to intellectual property, and more are often stored in virtual data rooms.

All of this information should be accessible to a company as and when required but should also be kept in a guarded place to protect it from getting stolen or hacked.

Read more: Best Cloud Document Management System in 2021

Why Use a Virtual Data Room?

With the globalization of business, organizations now make use of technology to be more efficient, reduce overhead, and outsmart the competition. If you are not making use of technology in your business processes, you are lacking behind.

Earlier, physical data rooms were used to disclose and share documents during a deal. However, since they were a lot more time consuming and inconvenient for the people involved, they were replaced by their more efficient cousin- virtual data rooms.

Moreover, switching from paper to digital documents not only gets rid of the incompetence linked with paper documents, but also helps save extra operating costs like maintenance, printing, filing, and storing paper safely.

Moreover, switching from paper to digital documents not only gets rid of the incompetence linked with paper documents, but also helps save extra operating costs like maintenance, printing, filing, and storing paper safely.

Virtual data room software has become the norm for financial transactions, as they are the ones which need hefty due diligence. Thanks to modern-day technology being secure as ever, VDRs are considered the safest bet to conduct financial deals, way more than a physical data room.

The fact that VDR software can be accessed from anywhere around the globe makes it easy to conduct deals internationally without the hassle of traveling and other constraints related to it.

Here are some of the reasons why companies use virtual data rooms:

1. IPO

Going public and offering an initial public offering (IPO) is a mountainous task requiring an incredible amount of paperwork. Going public would mean that your business now requires greater transparency than ever with the public, the state, as well as the shareholders.

In order to manage all that plethora of documents and launching an IPO, a VDR is a must-have. Since a lot of third parties will be involved in the IPO process, using a virtual data room ensures that all sensitive company information is safely shared amongst shareholders.

2. Mergers & Acquisitions

One of the most common use-cases of a virtual data room is mergers and acquisitions or M&A. When your business is getting acquired by a large entity or is being merged with another business, it typically requires a ton of due diligence.

The concerned parties often indulge in reviewing a lot of documents and files, most of which contain highly sensitive and private data. Conducting such mergers and acquisitions via a virtual data room is the safest and easiest way to go about it.

The concerned parties often indulge in reviewing a lot of documents and files, most of which contain highly sensitive and private data. Conducting such mergers and acquisitions via a virtual data room is the safest and easiest way to go about it.

Sharing intimate documents can be nerve-wracking for businesses, especially if the deal falls flat. In the event that the deal does not close, businesses can easily revoke access to their VDR software and keep their documents safe.

Read more: Virtual Workspace: Definition, Importance, and Tools

3. Partnerships

Even when businesses do not formally merge or acquire another business, they often partner up with one another to manufacture raw materials, enter a new market, or start an entirely new venture together.

These strategic partnerships are made to benefit both businesses and thus require a lot of data sharing with each other. Using virtual data room software can help tremendously in such situations, allowing sharing of information between firms and at the same time, keeping it safe and secure.

4. Conducting Audits

Auditors or legal teams often have to audit company policies, procedures, accounts, and more. In such situations, it’s imperative that your company’s data and important documents need to be shared, external auditors or regulators.

In such cases, using virtual data room software can prove invaluable as it allows you to comply with regulator’s guidelines and at the same time, minimize the risk of your private info being compromised.

In such cases, using virtual data room software can prove invaluable as it allows you to comply with regulator’s guidelines and at the same time, minimize the risk of your private info being compromised.

5. Raising Capital

Not having enough cash to sustain a new business is one of the key reasons why businesses fail. This is why it’s crucial to keep the investments coming in. However, raising funds for your company ain’t easy. Apart from convincing investors why your product/service is the best, it involves sharing private financial and other details about your business with investors.

During these fundraising rounds, businesses often use a VDR tool to facilitate information sharing with stakeholders and prospects. This not only helps you share the required documents with investors easily but also allows you to actively take part in the due diligence conducted by investors without worrying about your sensitive documents.

6. Any type of Document Sharing

A global survey of workers and IT professionals in 2012 by IDC revealed that document challenges account for 21.3 percent of productivity loss! This lost productivity causes millions of dollars every year for businesses. We often can’t find the right documents or files when we urgently need them or can’t access the document due to location barriers, especially if you have a remote team.

Moreover, around 20 percent of the business time – the equivalent of one day per working week – is wasted by employees searching for information to do their job efficiently. Having a robust VDR software makes this process of sharing documents with employees, clients, partners, investors, or any third party auditors a breeze.

Moreover, around 20 percent of the business time – the equivalent of one day per working week – is wasted by employees searching for information to do their job efficiently. Having a robust VDR software makes this process of sharing documents with employees, clients, partners, investors, or any third party auditors a breeze.

Final Words

Going digital and keeping your documents in a virtual data room ensures all your company knowledge and data are safe and secure from bad actors and human negligence.

Virtual data rooms are a tried and tested method to share intimate documents and files both internally and externally, providing you with much-needed peace of mind. So, what are your thought on virtual data rooms? Have you used one before? Let us know by tweeting us @bit_docs.

Further reads:

- Cloud Storage Solutions: What you need to know

12 Secure File Sharing Sites and Tools for Easy Collaboration

Related posts

Bit.ai | Watch to Learn More

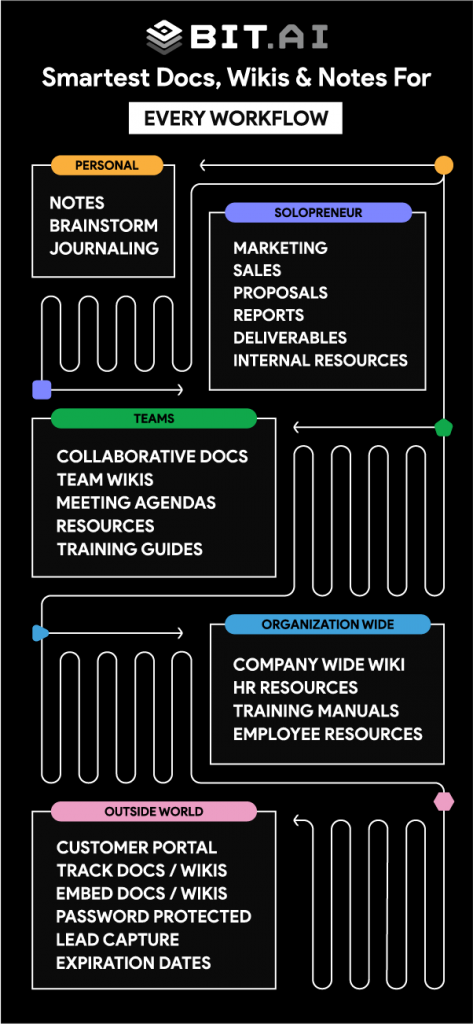

What is Bit.ai?

Bit.ai is an innovative AI-driven knowledge and Document Managment suite designed to empower knowledge workers by streamlining the creation of, documents, wikis, and notes. With an intuitive interface and seamless integration, Bit.ai acts as a versatile assistant to help you collaborate, generate, organize, and visualize your ideas effortlessly. Whether you are drafting a report, managing a project, collaborating with your team or clients, or brainstorming new concepts, Bit.ai brings intelligence and creativity to every aspect of your work process.