Running a business isn’t always rainbows and sunshine. There might be a few business aspects that you don’t find very ‘thrilling’, and creating financial documents is certainly one of them.

Nonetheless, financial documents are effective and indispensable tools that give you insight into your business and help you make smart business moves. They’re like the financial dashboard of your business!

Do you remember the dialogue from Jerry Maguire – “Show me the money“? That’s what financial documents do. They show you where your company’s money is coming from, where it is going, and where it currently is.

Want to learn more about financial documents? You’re at the right place! In this blog, we will go over six types of financial documents and how you can create them – so your business can run like a well-oiled machine.

What Exactly are Financial Documents?(Definition)

Financial documents are reports or statements that contain the details of the organization’s financial position, such as assets, liabilities, cash flow, incomes and expenses, shareholders’ contributions, and other such information during a particular period of time.

Many individuals and bodies rely on an organization’s financial statements to understand more about the organization. Investors, government authorities, shareholders, employees, customers, clients, and many other parties can benefit from the financial information laid in the financial statements.

Now that you know what financial statements are, let’s get to the heart of this blog: six financial documents that every organization must create!

List of 6 Financial Documents Every Organization Should Create

1. Profit & Loss Statement or Income Statement

A profit and loss statement, also known as an income statement, summarizes the business revenues and expenses over a particular period of time. This financial document helps an organization evaluate its current financial condition and the prospects for growth.

Basically, whatever is left after the expenses are deducted is the ‘profit’. So, if your expenses are more than the revenue, your P&L statement would show a loss. Continuous losses are a major red flag, and by staying on top of this financial document, you can identify the problems and address them.

2. Balance Sheet

Just like a profit and loss statement, a balance sheet helps you understand how your business is doing at a certain time period (year to year, quarter by quarter, etc). However, unlike a P&L statement, a balance sheet gives you a picture of your business’s assets, liabilities, and equity.

Some examples of assets are money in the current account of the business, inventory, real estate, machinery, etc. Liabilities could be the costs for producing goods, business loans, etc. The cash invested by the owner or investors and the retained earnings are examples of equity.

3. Cash Flow Statement

Did you know that 82% of small businesses fail to succeed because of cash flow problems? If you don’t want your business to become a part of this stat, you need to regularly examine your cash flow statement. It helps you plan your day-to-day and long-term investments, and shows your business’ cash position to the investors!

For a business to run smoothly, there are fixed and variable costs that need to be paid using the funds that your business generates. The cash flow statement indicates if your business is capable of doing this. It’s more like a budget and is used to forecast the revenue and expenses over a time period.

4. Tax Returns

As a business owner, it’s really important to stay on top of your business taxes, as well as the personal taxes that you might be liable for. The tax form that you file will be entirely dependent on the kind of business you have, and there are different income tax rules that apply to each kind.

Usually, businesses use CAs, CPAs, and other tax professionals to help them file their taxes. No matter whose help you’re taking, make sure that you review everything as it can help you and your finance team to create growth plan that can do wonders for your business.

5. Accounts Receivable/Accounts Payable or Aging Reports

Accounts receivable refers to the debts owed to your business, whereas, accounts payable is the amount that your business owes to creditors. In an aging report, you categorize the debts owed to your business, along with the duration for which they have been outstanding.

In businesses, the general perception is that the older a debt is, the lesser the chances that it will be paid. If someone fails to pay the funds they owe to a business, the business will lose money and might have an unhealthy cash flow. That’s why you need to create aging reports and take action to bring money in.

Read More: Annual Report: What is it & How to Create it?

6. Notes to Accounts or Notes to Financial Statements

In simple words, notes to accounts or notes to financial statements are supporting information that is provided along with the company’s financial statements. These notes contain details regarding the provisions, reserves, share capital, inventory, depreciation, and more.

The information mentioned in ‘notes to accounts’ is critical for understanding and evaluating the financial statement of the organization. It also helps in estimating the future performance of the company, and determining if the accounting policies are properly implemented and reflected in the statements.

We’ve discussed all the important financial documents that you should create. But what about actually creating these documents and tracking/reporting the results?

We know that creating personal financial documents can be a complicated and cumbersome process. However, if you want to thrive in today’s fast-changing world, you need to automate your processes and increase your productivity.

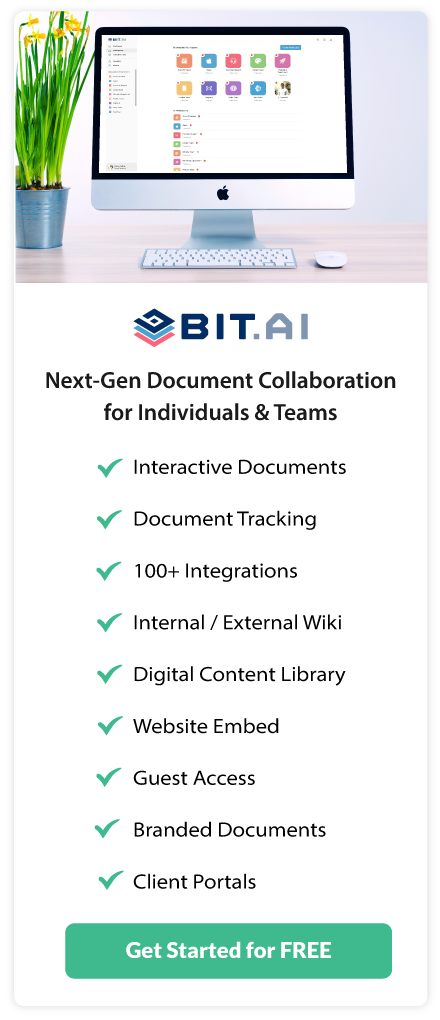

Fortunately, we have something to make your life easy. Whether you need need to create basic financial documents or super complicated ones, Bit.ai is just what you need.

Bit.ai – The Best Platform For Creating Financial Documents

Bit.ai is a platform that allows individuals and teams to create, manage, share, and track documents – all under the same roof. Using Bit, you can create and share documents that are the best in class, easy to read, and the ones that lead to great things. Don’t believe us? Check out all these mind-blowing features of Bit! (P.S. This is just the tip of the iceberg because Bit has so much more to offer!)

1. Pre-Built, Beautiful & Fully-Responsive Templates

No matter which financial document you want to create – there’s a beautiful template for that on Bit. With over 90 pre-built and fully responsive templates, Bit has made the painful task of creating documents simple.

2. Smart Workspaces

Organizing and managing all your financial documents can be a pain, but Bit is here to take the pain away. On Bit, you can create workspaces around projects, teams, departments, and clients to keep all your work organized. That’s not it! You can add unlimited collaborators to your workspaces.

3. Real-Time Collaboration

This is probably one of the coolest features of Bit. No matter where your team is located, you can keep everyone on the same page. You can co-edit, make inline comments, access version history, chat via document chat, @mentions, and much more!

4. Interactive Documents

Bit lets you add PDFs, charts, videos, maps, surveys/polls, charts – basically all kinds of rich media in your document. Right now, there are over 100 rich media embed integrations on Bit! So, why give someone a boring, static financial document they’ll never open when you could turn it into something much more engaging?

5. Tables

It’s better to show all the data and figures in your financial documents through tables. This way, everyone who reads your document would be able to grasp the complex figures in a quick glance. On Bit, you can create wonderfully designed and fully responsive tables with the click of a button. The colors of these tables automatically change according to the colors of your document’s theme.

6. Sharing & Permissions

Yes, the people who are already there in your workspace can see the financial documents whenever they want. However, there are more ways to share your Bit document! You can create a shareable live link, embed your docs onto any website and even invite guests into your workspace.

7. Guest Access

The ‘guests’ can get two types of access to the documents: comment-only and read-only. With the comment-only access, they can @mention people in the workspace and give their suggestions, while the read-only access only allows them to read the document you have shared with them.

8. Safe & Secure

Bit allows you to manage permissions and give access to your team members in a way that fits your organizational needs. The platform supports features like password protection, file access restrictions, document tracking, etc. that help keep your financial documents safe and secure.

Wrapping Up

Even though we’ve discussed each financial statement in this blog separately, remember that they are all related. If there’s a change in your assets and liabilities on your balance sheets, this change will also be reflected in your income statement…and so on.

Separately, each of these financial statements depict a different picture of an organization’s financial position at a particular point in time. However, when combined, these statements provide very powerful information about a company’s financial position during the time period in question!

Further Reads:

Financial Plan: What is it & How to Create an Impressive One?

Personal Financial Statement: What is it & How to Create a Solid One?

Top 10 Financial Tools for Businesses in 2022!

11 Budgeting Tools & Software to Keep Track of Business’s Budgets!

Related posts

About Bit.ai

Bit.ai is the essential next-gen workplace and document collaboration platform. that helps teams share knowledge by connecting any type of digital content. With this intuitive, cloud-based solution, anyone can work visually and collaborate in real-time while creating internal notes, team projects, knowledge bases, client-facing content, and more.

The smartest online Google Docs and Word alternative, Bit.ai is used in over 100 countries by professionals everywhere, from IT teams creating internal documentation and knowledge bases, to sales and marketing teams sharing client materials and client portals.

👉👉Click Here to Check out Bit.ai.