Did you know that 4 in 10 adults, if faced with an unexpected expense of $400, would not be able to cover it?

So many people are living paycheck to paycheck, unaware of the disastrous consequences it can lead to.

The unpredictability of life was well-demonstrated last year when the world was taken by a storm by the Coronavirus.

Millions of people were left jobless while others took a sharp pay-cut.

Last year should be a wake-up call for people who don’t take financial planning seriously and live paycheck to paycheck.

While it’s certainly hard for some to save money, it’s entirely possible with a bit of planning.

This is why we decided to talk about the benefits of creating a financial plan and how to create one quickly.

But before we jump into the “how”, let us first quickly understand what exactly do we mean by a financial plan.

What is a Financial Plan?

A financial plan is a document outlining a person’s current financial situation and long-term financial goals.

The document also consists of strategies and tactics to achieve those monetary goals.

A financial plan can be created for an individual or for an organization and can be created independently or with the help of a financial planner.

Now that you know what a financial plan is, let’s get to the reasons why you need to create one!

Read more: Project Budget Plan: What is it & How to Create it?

How Creating a Financial Plan is Beneficial?

A whopping 78 percent of people with a financial plan pay their bills on time and save each month vs. only 38 percent of people who don’t have a plan.

Moreover, 68 percent of people with a financial plan have an emergency fund while only 26 percent of non-planners are financially prepared to cover an unexpected cost!

Creating a financial plan can be beneficial to your wellbeing in a ton of different ways:

- A financial plan provides you with a better understanding of your current monetary situation.

- Financial planning helps you set future monetary goals and provides you with ways to achieve those goals.

- Such a document acts as a great source of motivation and keeps you accountable for your expenses.

- It acts as a guide for progress and decision-making

There are a few fundamental steps everyone needs to take before creating a financial plan. Let’s find out what they are!

How to Create a Financial Plan?

Step #1: Determine what you want to achieve.

The “why” behind your financial planning is crucial. It’s the reason behind something that motivates you to do the hard work and achieve success.

Knowing why you want financial independence or simply want your finances to be straightened out is important.

Determine both your short-term and long-term needs and wants.

What do you want your money to accomplish 5 years from now? Why do you want to save long-term?

Your goal in the next 5 years could be to pay off your student loan. It could be to own a car.

On the other hand, your long-term goal (10-15 years down the line) could be to buy a nice house.

Identify your goals, write them down, then prioritize accordingly. Such goals act as a motivating factor for you to save up for your future.

A great way to set goals is by following the S.M.A.R.T framework of goal setting.

SMART is an acronym for – specific, measurable, achievable, relevant, and time-bound.

List down the specific financial goals you want to achieve in the future, create a system to measure them, make them realistic, only include things you actually care about, and lastly, keep yourself accountable by making them time-bound!

Step#2: Know your worth

Knowing where you stand today is important.

Such knowledge helps you identify the steps you need to take to go where you want to.

Once you know your current worth and the subsequent financials required to achieve your future goals, you can build out a roadmap for success instead of spinning off your wheels and not going anywhere.

One technique to figure out your current financial situation is to determine your net worth by subtracting your liabilities from your assets.

Assets are the things that bring you money – savings account, real estate, stock investments, home/car equity, etc. On the other hand, liabilities are things that cost you money- student loans, debt, mortgages, etc.

Create a comprehensive list of all your assets and liabilities. Once you are done, subtract your liabilities from your assets and you have your net worth.

If you have a positive-sum, your financial status is said to be healthy. However, if you’re in the minus, you don’t have to worry about it.

Many people, especially students, start off their journey towards financial freedom in this way as they usually have loans and other debts to pay off.

No matter your current financial situation, you can use your net worth as a benchmark to measure your progress!

Step #3: Track cash flow

Cash flow is calculated by subtracting your income from your expenditure.

How much money do you make each month? This can include your salary, rent from real estate, dividends from stocks, etc.

Next, look at how much money goes out of your account each month, i.e., your monthly expenses. A great way to measure expenses is to look at your bank statement for the month.

The difference between your income and expenditure will determine your cash flow.

A positive cash flow means that you are saving more than you are spending, indicating that you are on the right path towards financial stability.

On the other hand, a negative cash flow means that you are spending more than you are earning.

This is a big red flag if you want to achieve your long-term financial goals and usually leads to credit card debts and even bankruptcy.

Step #4: Budget it out!

Creating a budget for your spending is a great way to keep your finances in check.

Creating a budget helps you identify areas of your life you can afford to spend and where you should be saving up.

If you don’t know how to create a budget, you can follow the 50/30/20 model of budgeting.

Popularised by Senator Elizabeth Warren in her book All Your Worth: The Ultimate Lifetime Money Plan, the “50/30/20 budget rule” is one of the simplest and effective ways to create a budget.

According to this rule, you divide your after-tax income into three categories:

- Essentials (50 percent)

- Wants (30 percent)

- Savings (20 percent)

This means that one needs to allocate 50% of their income to essential purchases (example, groceries, rent, etc), 30% to their wants (example, clothes, eating out, etc), and 20% of their income should directly go into saving (example, savings bank account, investments, etc).

While most people include expenses like rent, groceries, and dining out while creating a budget, there are many small expenses they miss out on.

For example, if you regularly drink your coffee from Starbucks, those $10 lattes all add up.

Here are a few things you should include in your budget:

- Groceries

- Rent

- Dining

- Clothes

- Subscription (Netflix, Spotify, etc)

- Memberships

- Household maintenance

- Car repair

- Charity

- Emergency fund

- Transport

- Personal care

Keeping tabs on your expenses and maintaining a budget can easily put you on track to achieve your financial goals!

Read more: Personal Financial Statement: What is it & How to Create a Solid One?

Step #5: Pay off your debt

Debt is often the crutch holding you back from financial freedom. It’s hard to keep aside money to pay back loans.

However, the quicker you pay off your debt, the better it would be for your finances in the long run.

For home debt, try to follow the 28/36 guideline which suggests you keep about 28% of your pre-tax income towards home debt and about 36% towards all debt.

Step #6: Keep an eye on your investments

Investing money into the stock market, bonds, and mutual funds can be a great way to put your existing income to work and grow your wealth.

However, investment is no child’s play. You need to periodically monitor the market and see if everything is going according to plan.

If you don’t know anything about investing, we would advise you to get your basics in place before investing your hard-earned money. There are many free and paid resources online where you can learn about investing and get educated.

Since markets are prone to turbulence, keep a check on your investment portfolio periodically and make sure to review and rebalance your portfolio accordingly.

Step #7: Plan your retirement

If you are just starting out your professional career, planning for retirement might seem like a preposterous goal. However, just like financial planning, retirement planning should be done as early in your career as possible.

The earlier you start saving up for your retirement, the better future you are going to have. Saving for retirement is an integral part of a financial plan and requires a ton of discipline.

There are many types of retirement savings plans, with the 2 most common being the IRA and a 401(k).

An IRA is a personal retirement account that you start and fund without the help of an employer. The savings you have in this type of retirement account is tax-deductible.

On the other hand, a 401(k) is a retirement account granted by a company to its employees. In this type of retirement account, you can choose to make pre-tax or post-tax contributions.

Whatever your age, retirement saving should be a part of your financial plan!

Read more: Cost Management Plan: What, Why, and How?

Step #8: Don’t forget to insure!

We know insurance is boring and dull but it’s as important as any other step on this list. Ensuring your assets is a great way to protect them against any disaster or emergency.

Insurance is a key element of your financial plan as it safeguards your hard-earned money against any unforeseen disasters.

There are many types of insurance that protect different types of assets. Some of the most common and essential insurances include:

- Health insurance: As Confucious said, “A healthy man wants a thousand things, a sick man only wants one.” The greatest asset you own is your health. This is why it’s crucial to have health insurance as it can help cover those absurd medical bills in case of an emergency without messing your financial progress.

- Life insurance: If you have dependents, it’s important to have life insurance as it can aid your beneficiaries with the required funds after your passing.

- Homeowners/Renter’s insurance: If you own real estate, it’s crucial to have homeowner’s insurance to protect your property against disasters or crime. Since real-estate can be your most valued asset, protecting it against disaster is a no-brainer.

- Motor insurance: Motor or Automobile insurance provides protection from costs incurred due to damage to your car or theft.

Bit.ai: The Ultimate Tool For Creating a Financial Plan

Well now that you know the importance of creating a financial plan and the steps needed to create one, you’re onto the final step – finding a documentation tool to create a financial plan with.

Our go-to choice of documentation tool is Bit.ai.

Our go-to choice of documentation tool is Bit.ai.

An all-in-one document management platform, Bit is great for anyone looking to create, organize, and manage media-rich and modern-day documents like financial plans.

Why? Here are some of the main benefits of using Bit:

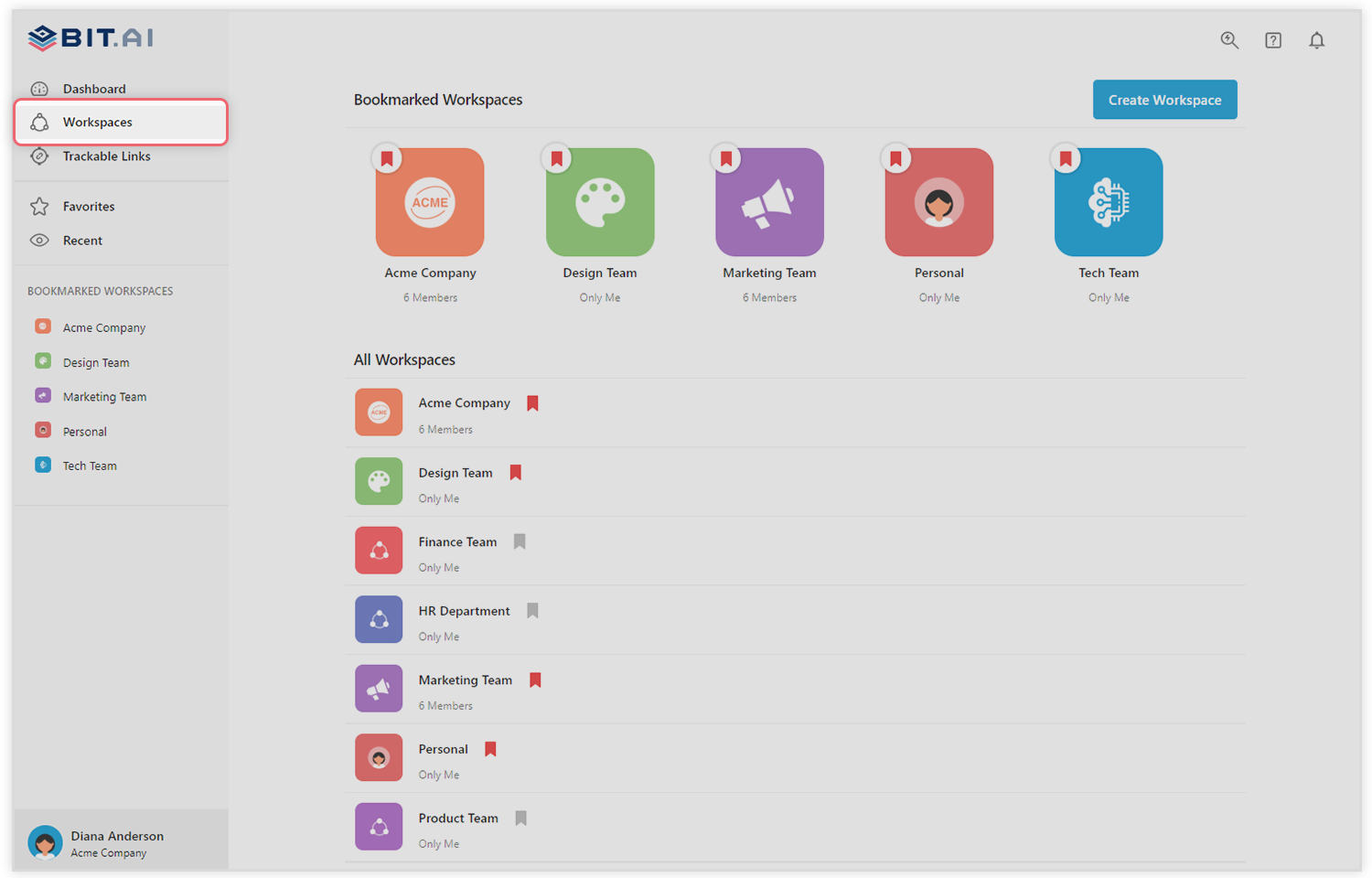

1. Organized Workspaces and Folders: If the words ‘mapping down your finances’ send shivers down your spine, you’re actually doing it the wrong way. It’s actually pretty easy – all you need to know is the right way to create and manage all your financial documents and that is Bit.ai. On Bit, you create and neatly organize all your documents like your financial plan in workspaces and folders! You can create as many workspaces as you want.

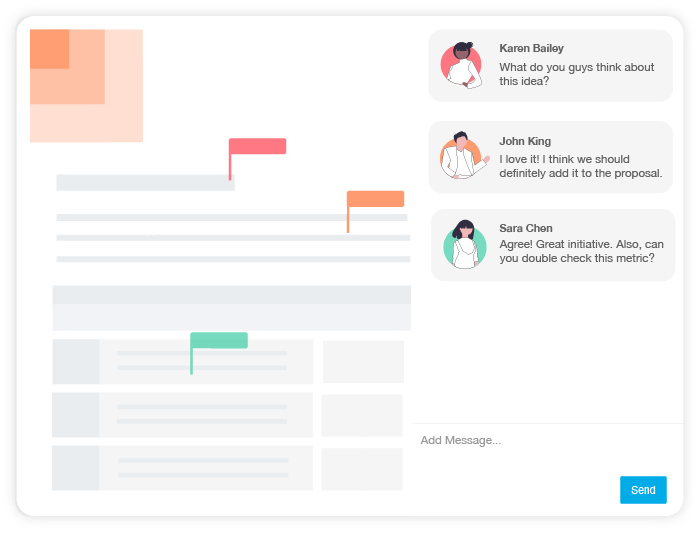

2. Real-time collaboration: Yes, you can certainly make your financial plan yourself. After all, who knows your expenses and needs more than you do? However, getting some outside help and insights never harms anybody. It will only make your financial plan much more efficient. On Bit, you can add a friend, relative, or colleague to your workspace and work together in real-time on your financial plan using @mentions and highlight features. Sounds super fun, doesn’t it?

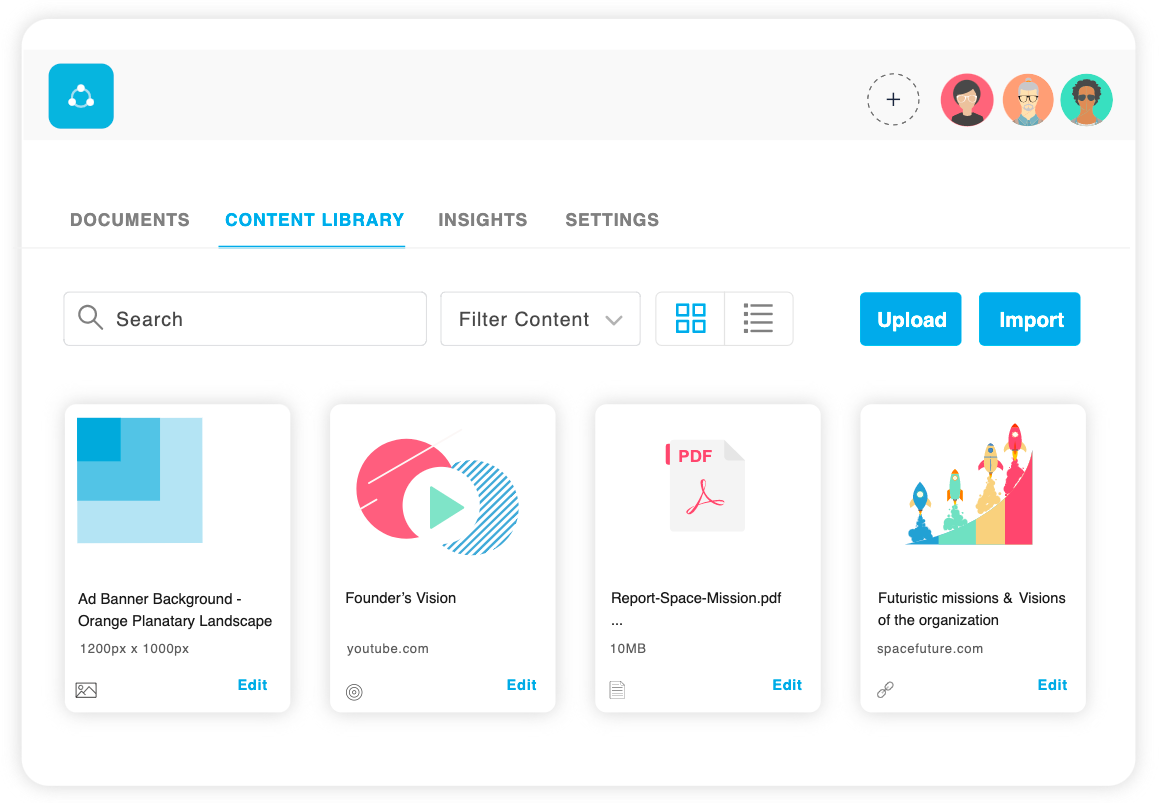

3. Content Library: From insurance documents to receipts of the day-to-day expenses – keeping track of all these documents isn’t an easy task. Bit.ai totally understands that and that’s exactly why it gives you a space to upload and organize all your important images, files, videos, PDFs, and other media content in one place. You can access these files with ease whenever you want!

4. Rich Embed Options: The first thing that comes to someone’s mind whenever they hear the term ‘finance’ is excel sheets and tables, and with good reason. They’re the best way to make sense of all the complex numbers and figures. What if we tell you that you can embed your excels sheets, and so much more in your Bit doc? Yes! Bit.ai integrates with over 100+ web applications (Ex: Google sheets, Microsoft Onedrive, YouTube, PDFs, LucidChart, etc.) to help you create media-rich and interactive financial plans or any other document for that matter!

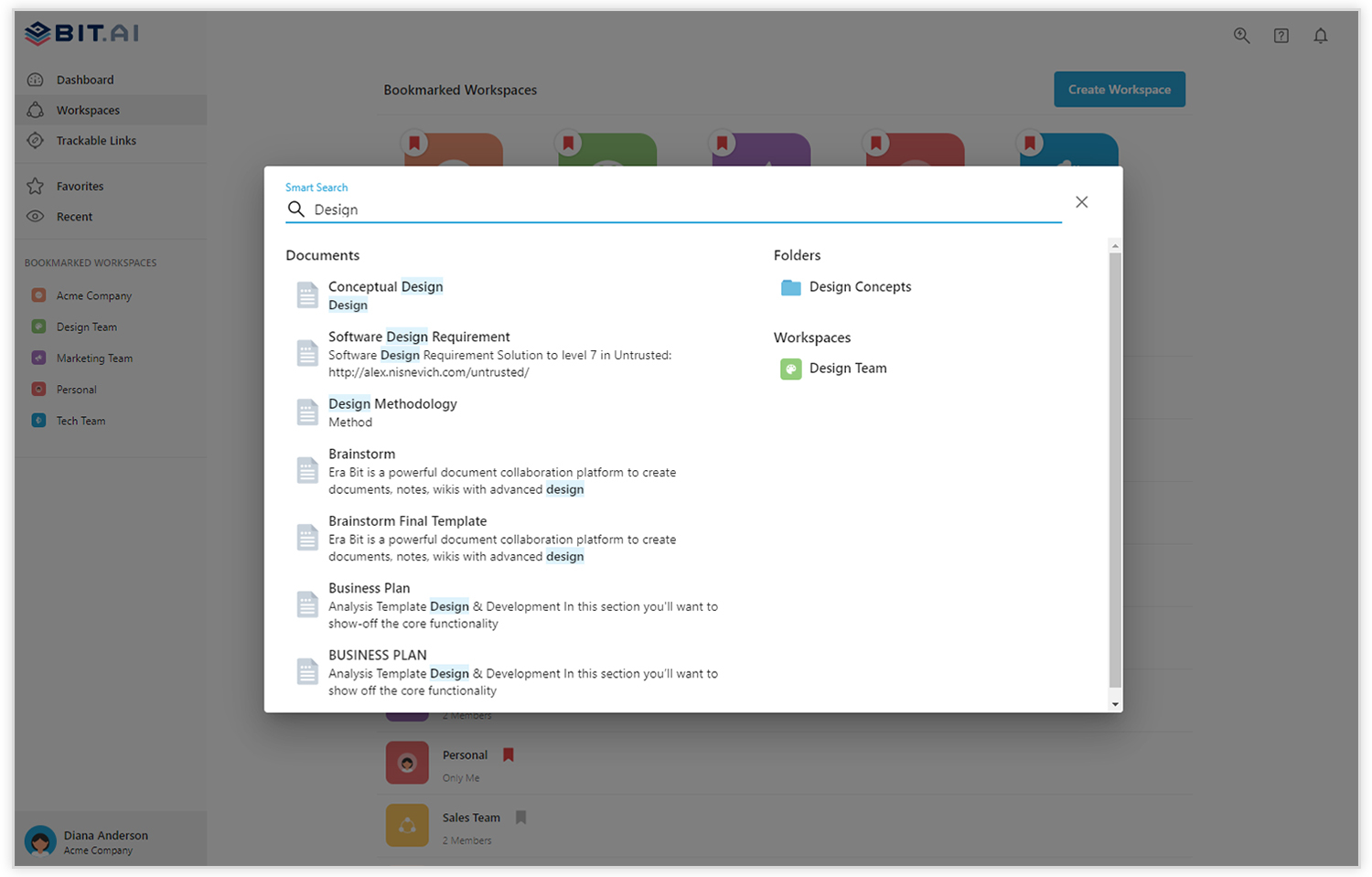

5. Smart Search: We’re sure you don’t want to go through the pain of searching for your important financial documents. Creating a financial plan is enough pain already. Don’t worry, Bit.ai has got you covered. It has a ‘smart search’ feature that allows you to quickly search for folders, files, documents, and content inside your documents across all of your workspaces.

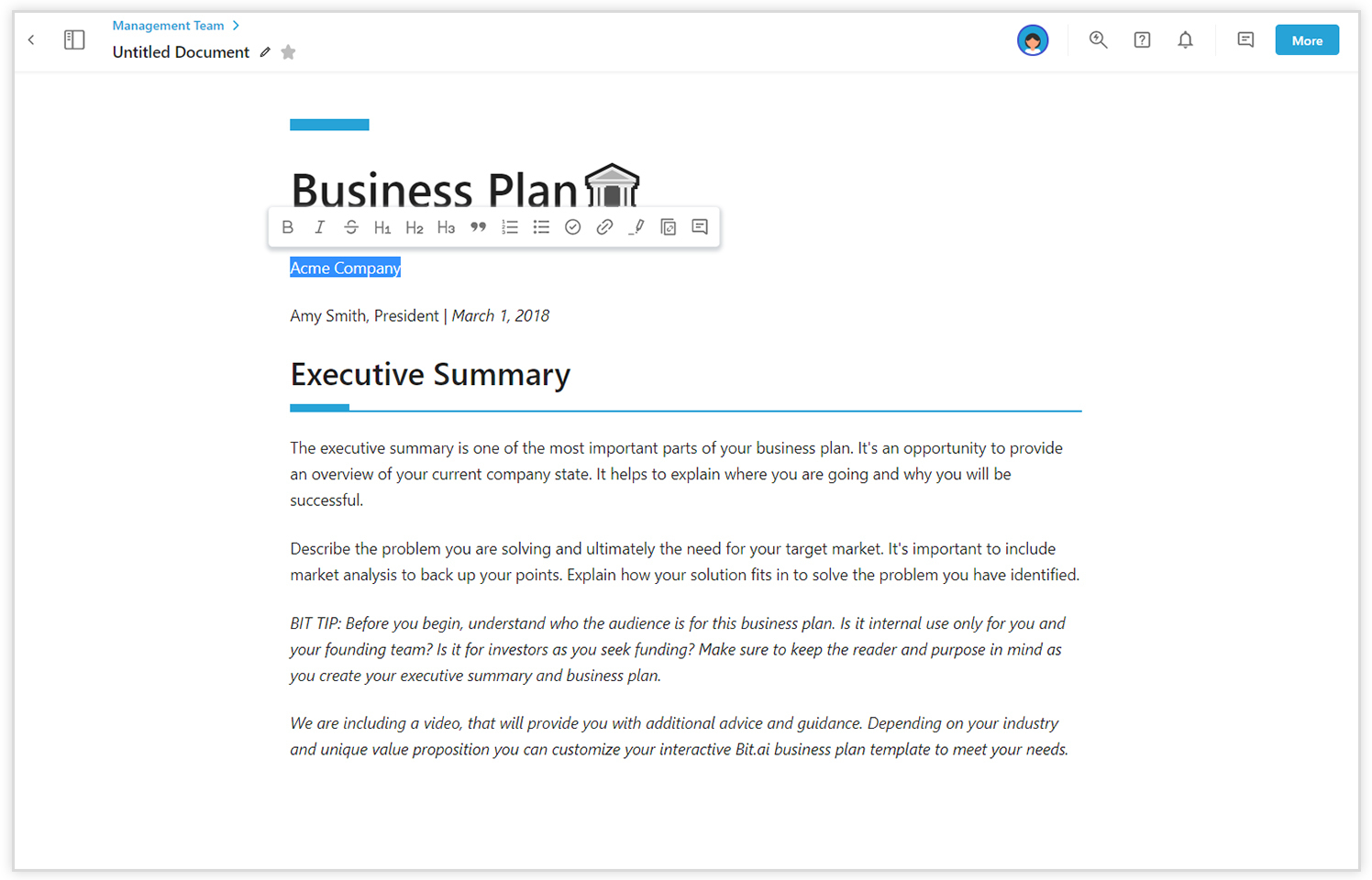

6. Beautiful Templates & Sleek Editor: Creating a financial plan sounds like a boring, complicated, and lengthy process. Well, not anymore. Bit.ai has over 70+ amazing templates that will cut your work in half and help you kickstart your financial plan quickly. That’s not it! Your financial plan certainly needs all your attention and that’s why Bit also offers a minimal and distraction-free editor. We’re sure you’re impressed.

6. Beautiful Templates & Sleek Editor: Creating a financial plan sounds like a boring, complicated, and lengthy process. Well, not anymore. Bit.ai has over 70+ amazing templates that will cut your work in half and help you kickstart your financial plan quickly. That’s not it! Your financial plan certainly needs all your attention and that’s why Bit also offers a minimal and distraction-free editor. We’re sure you’re impressed.

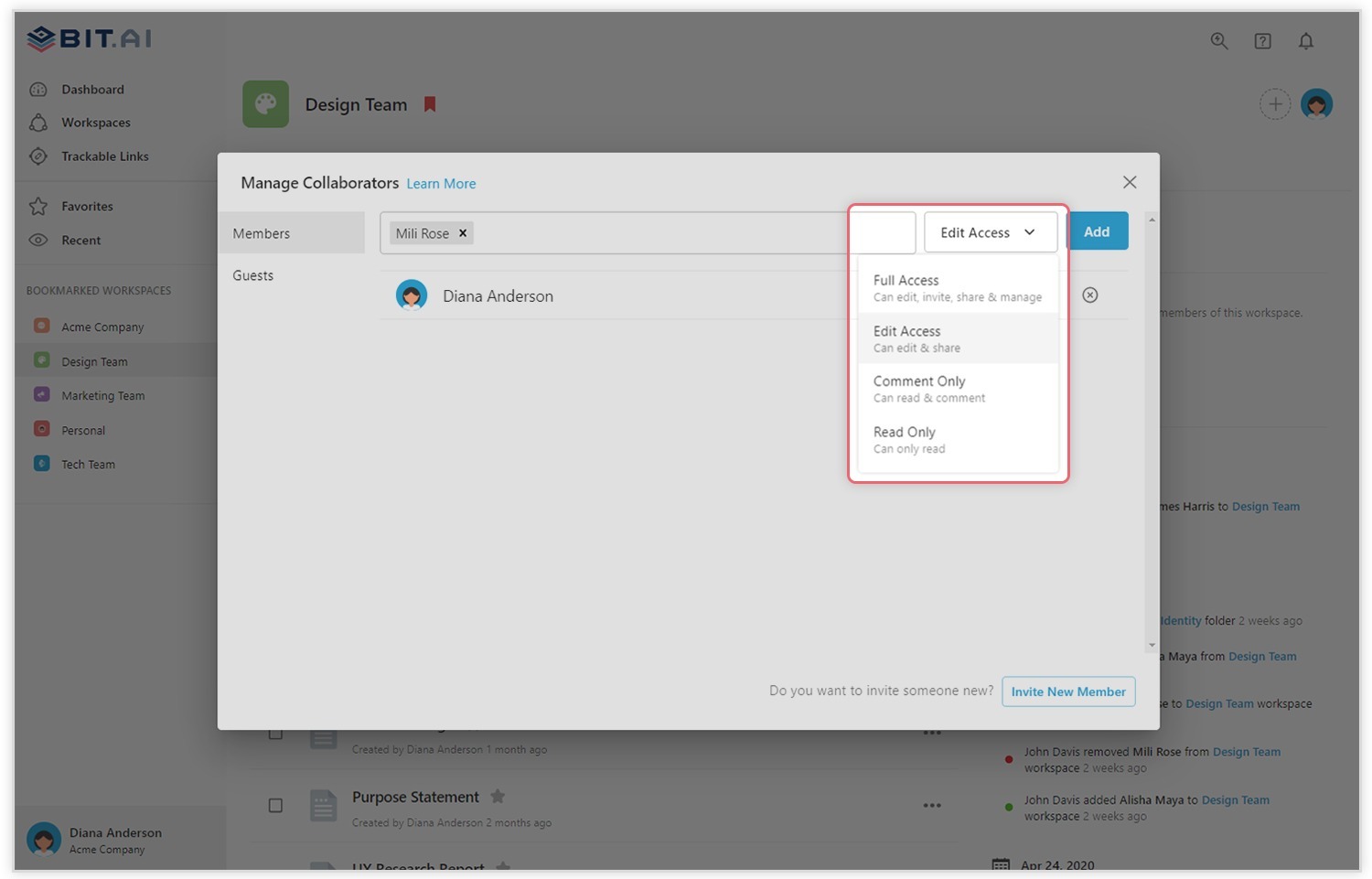

7. Sharing & Permissions: Incomes, expenditure, and a financial plan is a personal thing, and more often than not, you don’t want others to know all the details of it. Well, Bit supports features like password protection, file access restrictions, etc. that can help keep your financial plan super safe. Say goodbye to all the prying eyes!

Wrapping Up

So there you have it, folks – our comprehensive guide on financial planning to help you achieve financial success!

We hope you learned a lot today and are eager to kickstart your financial planning with Bit.ai.

If you have any other questions, feel free to reach out to us at @bit_docs and we’d be happy to help.

Good luck!

Further reads:

Self-Care Plan: What is it & How to Create an Effective One?

15 Most Important Financial KPIs You Should Be Tracking!

Top 10 Financial Tools for Businesses in 2022!

Growth Plan: What is it & How to Create One? (Steps Included)

Business Development Plan: What Is It And How To Create A Perfect One?

Tactical Plan: What is it & How to Create an Effective One?

Consulting Proposal: What is it & How to Create it? (Steps Included)

Related posts

About Bit.ai

Bit.ai is the essential next-gen workplace and document collaboration platform. that helps teams share knowledge by connecting any type of digital content. With this intuitive, cloud-based solution, anyone can work visually and collaborate in real-time while creating internal notes, team projects, knowledge bases, client-facing content, and more.

The smartest online Google Docs and Word alternative, Bit.ai is used in over 100 countries by professionals everywhere, from IT teams creating internal documentation and knowledge bases, to sales and marketing teams sharing client materials and client portals.

👉👉Click Here to Check out Bit.ai.