When you set up a company with your family or friends, you might assume that nothing will ever go wrong.

You might say, “Umm…I completely trust and respect my family and friends. I don’t need to create a contract or an agreement at all!”

Well, sorry for getting a little philosophical, but the thing is, nothing in life is certain. Even best friends and family members fall out.

And, if that happens, you could literally end up with nothing. (All those years of hard work down in the drain!)

Along with the breakdown of a friendship, you might also have to go through the pain of those never-ending legal disputes.

This is exactly why you need to put a shareholder’s agreement in place.

Think of this agreement as a prenup. Just like any other relationship, the relationship between shareholders goes through its up and down. (Yes, even when you’re the best of friends!)

So, just like a prenup, a well-drafted shareholder’s agreement can cover everything – from the “divorce” between the shareholders to all the other disputes that might arise in the decision-making process.

Now that we’ve convinced you that a shareholders’ agreement is more than just a piece of document, in this article, we will take you through everything you need to know about creating one!

Let’s get into it.

What is a Shareholders’ Agreement? (Definition)

A Shareholders’ Agreement (SHA) is essentially a contract between the shareholders and the company, that lays down the rights and obligations of the shareholders with respect to the company.

When a person holds the share of a company, they also hold responsibility and accountability towards the company.

The Shareholders’ agreement makes sure all the owners of the organization equally contribute to its wellbeing and operations take place in a fair manner.

That means, everything that a shareholder is expected and obliged to do is mentioned in the agreement.

So, how does it differ from the Article of Association prepared at the commencement of the company?

Firstly, the AoA is legally mandatory to prepare while a Shareholders’ agreement is not.

Although it is not required by law, almost all companies running a business with more than one person in the company prepare this legal document.

Secondly, the shareholder’s agreement focuses entirely on the rights, duties, and protection of the shareholders. Whereas the Article of Association covers more topics and subtopics regarding the formation of a company.

Some terms may be similar in the two documents, but a shareholders’ agreement details all parts where owners of the company are involved.

But is it necessary to create a shareholders’ agreement? Isn’t an AoA enough?

Read on as we explore the various advantages of having a shareholders’ agreement.

Read more: Consulting Agreement or Contract: What is it & How to Create it?

Advantages of a Shareholders’ Agreement

There are various advantages of having a separate shareholders’ agreement, the most important ones are listed below.

1. Protection of Minority Shareholders

Shareholders in any company can be divided into 2 broad groups – majority and minority.

Simply put, the people sitting on the chairs and running the company are the majority shareholders. They have 51% ownership in the company and take all major decisions.

The public, on the other hand, who buy some shares of the company through a stock exchange are an example of minority shareholders. They don’t have a say in the decisions of the company.

Due to this authority gap, minority shareholders can easily be exploited by the people in power.

A shareholders’ agreement ensures and grants protection, particularly to these minority shareholders, by clearly defining their rights and obligations towards the company.

This agreement makes sure that no such decision is taken by the board that harms or prejudices against the minority shareholders.

Read more: Founders’ Agreement: What is it & How to Create it?

2. Provides a Clear Set of Guidelines

Imagine how a country would work without a constitution! Sounds chaotic, right?

It is the same way with a shareholders’ agreement in a company. It lays down a set of rules and regulations to be followed by each shareholder for the business to run peacefully.

Without these rules, everyone would follow individual goals instead of organizational goals. That is never good for a company!

A shareholders’ agreement sets certain policies and procedures in place with respect to how the company will be run.

It ensures a consistent and uninterrupted workflow of the organization.

3. Resolution of Disputes

What happens in the case of a shareholder fallout? Or if he/she commits fraud?

There are numerous situations that may take place in the functioning of a company. The shareholders’ agreement is referred to solve every conflict.

It minimizes the potential for future conflict by laying down every situation in advance and explaining the action to be taken for it.

For instance, if there is a conflict of interest between two of the board members, the shareholders’ agreement will dictate how to resolve the matter.

4. Gives Some Authority to Shareholders

A shareholder, by definition, is called a part-owner of the company.

Even if a person owns one stock of your company, they are some percentage owner in the company and thus deserve to have some level of authority.

Generally, the day-to-day matters of a company are looked after by the directors of a company.

By having a shareholders agreement in place, some of these decisions can be put to the vote of shareholders, requiring their approval and giving them more authority in the company.

This makes the shareholders feel acknowledged and valued. It is a great practice for the long-term well-being of your company.

Now that you understand the importance of creating a shareholders’ agreement, let’s look into the process.

Read more: Operating Agreement: What is it & How to Draft One for your LLC?

Things You Must Include in your Shareholders’ Agreement

The Shareholders’ Agreement is certainly an important document of immense value.

However, it is fairly easy to draft. After all, it is your company and you can include any terms you think would be beneficial in the future.

It is a blank slate that you can customize keeping in mind the wellbeing of the company.

To get started, here are a few things you can include in a shareholders’ agreement.

1. Definitions and Interpretations

This section will lay down the definitions of certain terms which are going to be used in the rest of the document.

It provides clarity to both parties, the company, and shareholders while reading the document.

Some words or abbreviations might be brand-specific that needs to be enlisted in this section to avoid any confusion.

2. Capital Structure

This section defines the capital structure of the company in terms of the authorized share capital.

Share capital is the amount of money that the company has received from shareholders in exchange for equity. It is essential to lay down the capital structure so that the breakdown expressed in percentages is clear to everyone involved.

This section also specifies how future funding will be carried out.

Thus, if the company is in financial need, the procedure for issuing more shares is laid down in this portion of the agreement.

3. Restrictions on the Sale and Transfer of Shares

This is an important section from the point of view of shareholders.

It lays down rules and procedures agreed upon by both parties to ensure that if a sale or transfer of shares takes place, it is not against the will of shareholders, especially minority shareholders.

4. Management of the Company

A company usually has thousands of shareholders, owning small portions of the total shares.

Thus, it is not possible to consider everyone’s opinion on the decisions of the company.

In this section, you will specify the management, including the Board of Directors of the company.

This section should also include the composition of the Board, qualifications, process of voting, mode of conduct for meetings of the Board, and process of their resignation and removal.

It is important to note that the existence of a Board does not undermine the importance of shareholders in the decision-making process.

Thus, this section should also include the quorum, i.e. the number of people necessary for a meeting to be considered valid.

5. Rights and Obligations of the Shareholders

This is arguably the most important part of the agreement.

It lays down the quorum for shareholders’ meetings, the process of voting, shareholders’ rights, and their obligations towards the company.

Some rights that a shareholder can exercise in a company are- the right to vote, the right to call for a general meeting, the right to appoint the directors, the right to inspect the books of the company, tag-along rights, drag-along rights, right of first refusal, etc.

They are all mentioned in this section.

It also specifies certain special rights of the minority shareholders for their protection.

6. Representation and Warranties

As we mentioned above, the shareholders’ agreement is your blank slate that can be filled with rules and regulations that you want your company to adhere to.

However, it should be aligned with the legal system of the country and no section of the agreement should contradict or disobey any laws formulated by the government.

This section of the shareholders’ agreement ensures exactly this.

It specifies that no part of the agreement is against the applicable law, no parties involved in the agreement have any legal suit on them, and that the agreement is being formed with the consent of all the board members.

It is like a disclaimer for your shareholders’ agreement!

7. Miscellaneous

Any other thing left out can be mentioned in the miscellaneous section.

For instance, the procedure of termination of the agreement, arbitration in case disputes arise, applicable law that highlights which court’s jurisdiction will be followed in what case, and any other company-specific detail.

All these sections are concluded by undertakings and signatures of all the parties involved in the process.

Creating a shareholder’s agreement involves a lot of brainstorming and teamwork as you’re preparing a document for the future.

You have to lay down all the possible scenarios that may arise in the overall working span of a company.

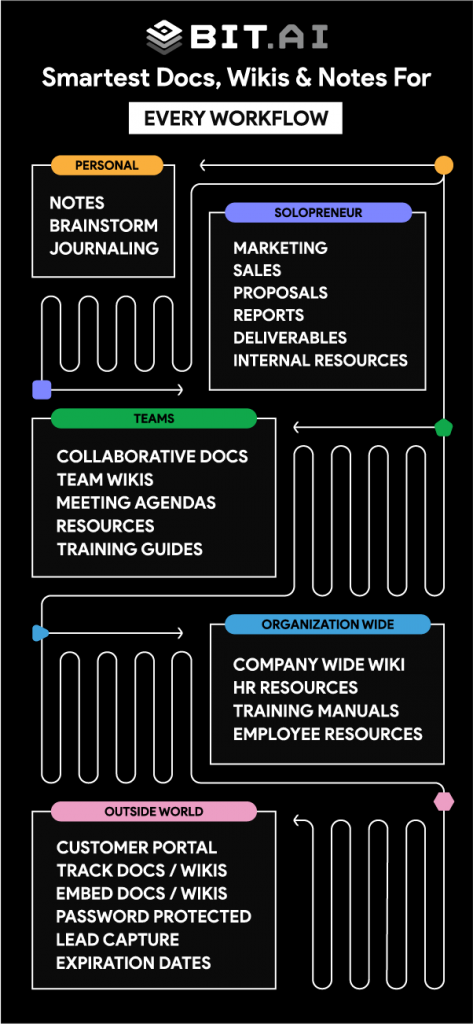

Bit is a smart document creator that eases up this work by automating operations and bringing all major activities related to your agreement, under one roof. It can cut your document creation time by half!

Too good to be true? Check out these amazing features of Bit to know for yourself!

Bit.ai: The Ultimate Tool to Create Shareholder’s Agreement

1. Real-Time Collaboration:

1. Real-Time Collaboration:

To create an agreement that is accepted by one and all, you need to work on it collaboratively. Bit allows seamless collaboration for you and your team wherein multiple people can work on the same document, chat privately, ping each other on documents to attract attention, post and pin important announcements, and even keep a track of teammate’s activities through Bit’s intuitive dashboard.

2. Fully Responsive Templates:

Writing a shareholders’ agreement is a lengthy process. Well, at least you don’t have to worry about the design element of it! Bit offers 70+ ready-to-use templates for various purposes ranging from a sales pitch to a goals tracker.

You can pick any design that you like and fully customize it your way. From header size to layouts, everything in a Bit template is customizable and fully responsive. That means no matter which device you access it on, your document looks great and interactive!

3. Interactive Documents:

Say goodbye to boring black and white text with Bit’s rich integrations. You can add all kinds of media from an Excel sheet to charts, videos, photos, and much more in your shareholders’ agreement.

If it’s going to be around for a long time, it might as well be attractive to look at, right? Bit is integrated with 100+ popular applications such as MS Office, Tableau, Google Drive, Airtable, etc. Simply paste the link of any rich media in your bit document and watch it come alive in seconds!

If it’s going to be around for a long time, it might as well be attractive to look at, right? Bit is integrated with 100+ popular applications such as MS Office, Tableau, Google Drive, Airtable, etc. Simply paste the link of any rich media in your bit document and watch it come alive in seconds!

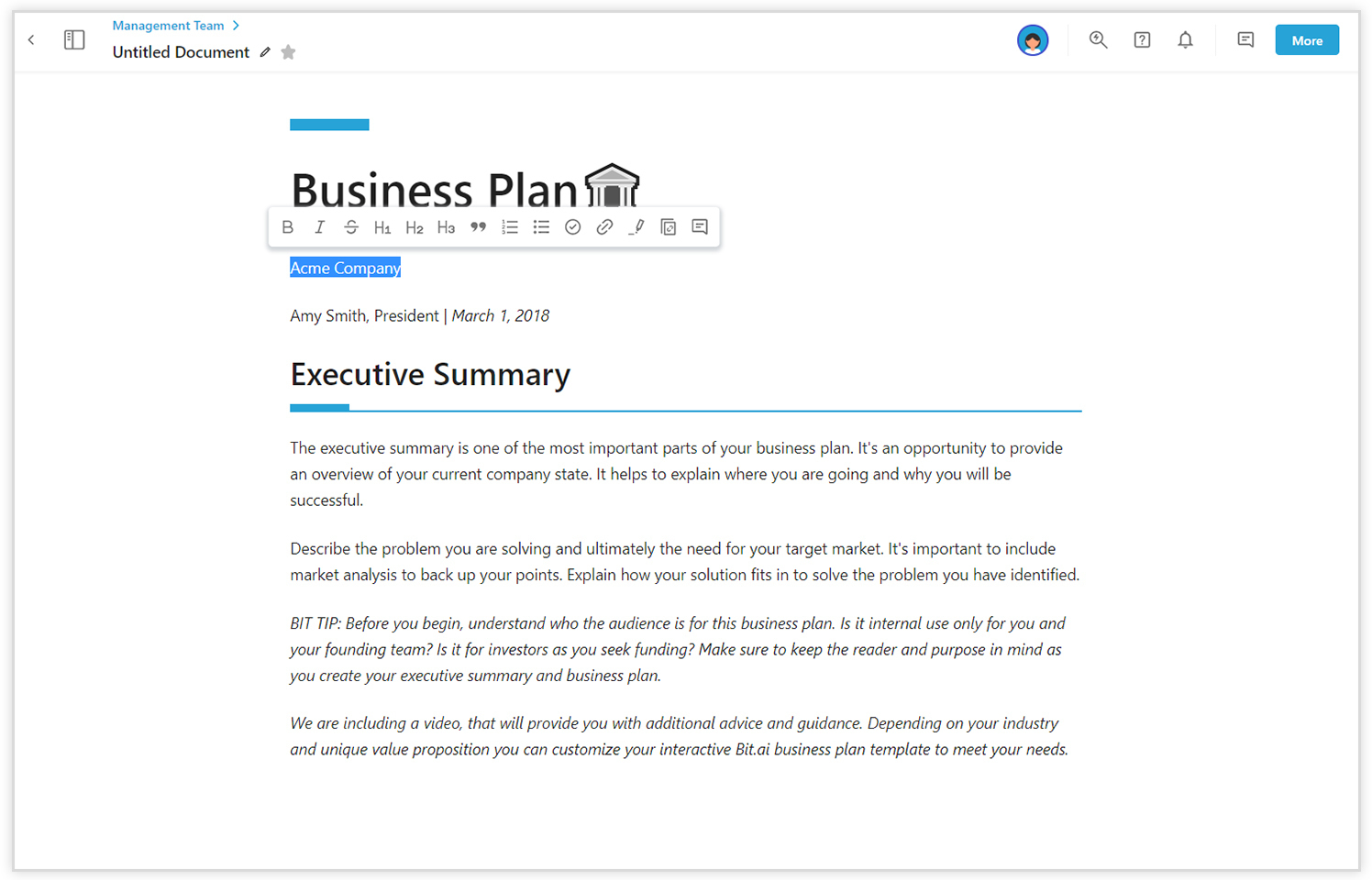

4. Sleek Editor:

We live in a world of distractions. To create amazing documents the user’s focus must be aligned at all times. Bit understands this and offers a distraction-free editor with a minimal design and no ads. It is super easy to use and navigate through all the features of Bit, thanks to its sleek editor!

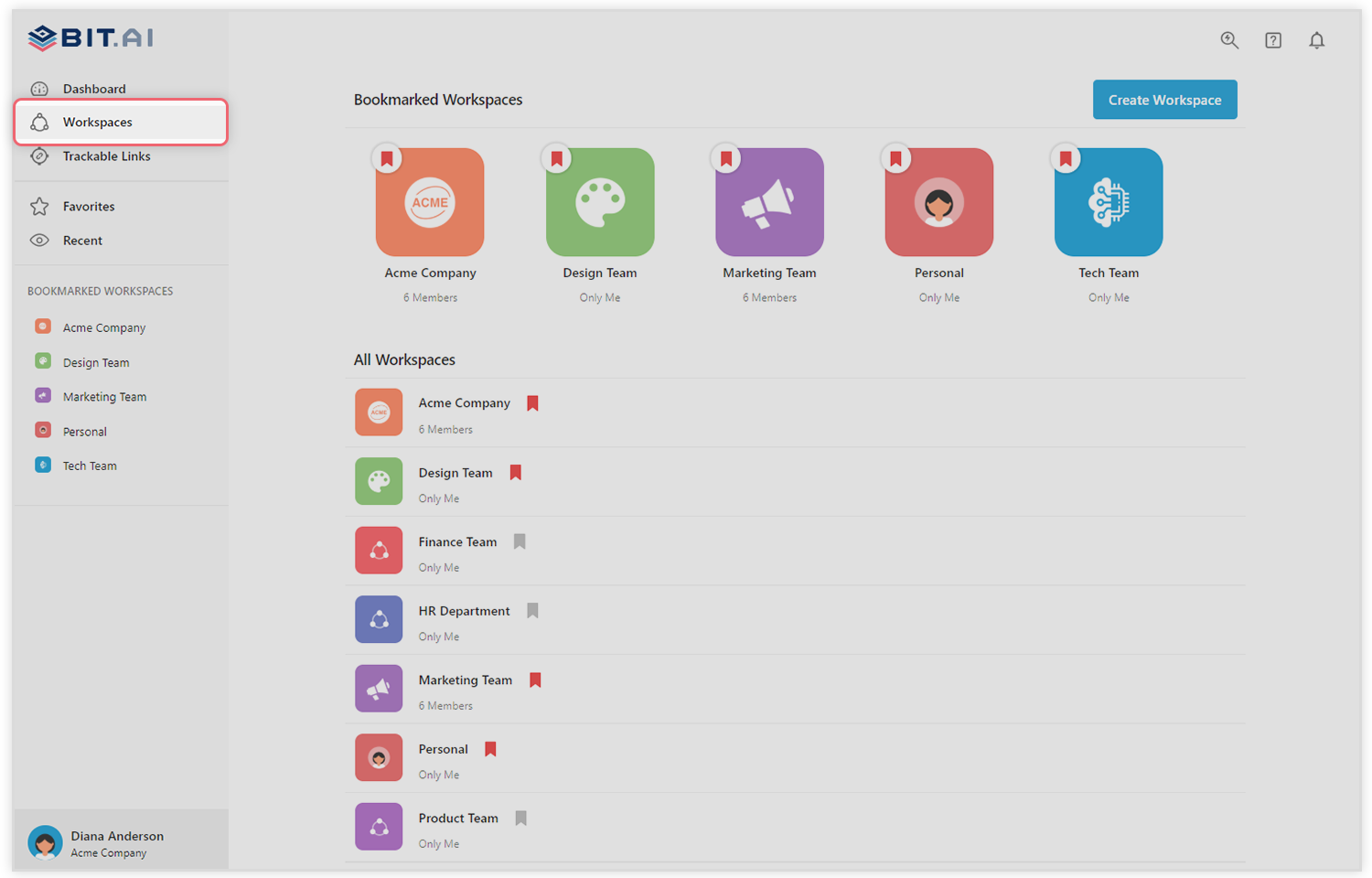

5. Smart Workspaces:

You can create multiple workspaces to keep all your teams and documents organized using Bit. Add people in a specific workspace and control the access you grant them. For instance, you want your team member XYZ to be involved in the making of the shareholders’ agreement but not in any of the other documents.

Simply create a shareholders’ agreement in a different workspace than other documents and voila, problem solved! Bit lets you be flexible with operations and work on your own terms.

Simply create a shareholders’ agreement in a different workspace than other documents and voila, problem solved! Bit lets you be flexible with operations and work on your own terms.

6. Content Management:

Writing a shareholders’ agreement involves a lot of brainstorming. Bit lets you store ideas in the form of media in its unique content library. Upload anything off the web, or from the cloud in the content library to use later in a document, or simply get inspiration!

7. Document Sharing:

There are several ways you can share documents with Bit. First is the usual export option wherein you can convert your Bit doc to Docx, PDF, and even rich text formats. The second is the link-sharing option.

When you create a document, you get to give it a unique link. This link can then be shared with anyone you want. Further, for private documents, you can invite someone into your workspace as a Guest. You can also control the access for your guests and give them view only, and comment only access.

8. Real-Time Insights:

You can also create trackable links to understand the user engagement on your Bit docs. You can gain useful insights into your work using the link tracking feature of Bit. Find the answer to who opened your document and how much time did they spend on it.

Conclusion

A shareholders’ agreement is an important tool for the effective management of a business.

Thus it must be created in a manner that sufficiently meets the needs of the company and the shareholders alike.

If there are loopholes in your SHA, it can lead to conflicts or even dilution of your firm!

Now that you understand a shareholder’s agreement in and out, make sure to create one for your company!

Let us know how it goes by tweeting us @bit_docs!

Further reads:

Operations Manual: What is it & How to Write it?

Profit-Sharing Agreement: What is it & How to Create it?

Purchase Agreement: What is it & How to Create it?

Related posts

Bit.ai | Watch to Learn More

What is Bit.ai?

Bit.ai is an innovative AI-driven knowledge and Document Managment suite designed to empower knowledge workers by streamlining the creation of, documents, wikis, and notes. With an intuitive interface and seamless integration, Bit.ai acts as a versatile assistant to help you collaborate, generate, organize, and visualize your ideas effortlessly. Whether you are drafting a report, managing a project, collaborating with your team or clients, or brainstorming new concepts, Bit.ai brings intelligence and creativity to every aspect of your work process.