The meeting room was noisy until one chart popped up and shut everyone up—a risk that got missed just cost the company a ton of money. All the department heads stared at the screen, realizing how one little thing they didn’t see coming turned into a huge problem.

Could better planning have stopped this? For sure.

In today’s business world, risk isn’t just a possibility — it’s a constant. Whether it’s a sudden market downturn, a data breach, or a supply chain delay, every organization faces uncertainty that can shake its stability. That’s where risk mitigation strategies step in — not as an afterthought, but as your business’s built-in defense system.

Think of risk mitigation like an airbag in a car. You don’t plan to crash, but you still have protection ready for the unexpected. The best businesses do the same — they prepare, plan, and protect themselves from what could go wrong before it ever does.

Risk mitigation isn’t just about reacting to problems — it’s about foreseeing them. When done right, it ensures business continuity, safeguards assets, and strengthens decision-making. And here’s the best part: today’s technology makes it easier than ever to track, document, and collaborate on risk mitigation efforts — together, in real time.

By the end of this blog, you’ll know exactly how to identify, apply, and manage risk mitigation strategies that fit your organization’s needs — and discover how tools like Bit.ai can turn your risk management plans into a living, evolving system.

What is Risk Mitigation? (Definition)

Have you ever wondered why some organizations seem to bounce back stronger after a crisis, while others crumble under pressure? The answer often lies in one powerful concept — risk mitigation.

In simple terms, risk mitigation means identifying potential threats before they become problems and taking deliberate steps to reduce their impact. It’s like installing a safety net under your business operations — you hope you never need it, but you’re protected if something unexpected happens.

Risk mitigation is taking action, whereas risk management is the more general category of evaluating, analyzing, and keeping an eye on threats. At this point, you implement specific plans, actions, and controls to reduce uncertainty.

Think of it like this 👇

- Risk Management is like your GPS when you’re traveling. It guides you on your way.

- Risk Mitigation is your seatbelt — it protects you when things go sideways.

Your goal isn’t to erase risk entirely, but to make sure that when challenges appear, they don’t knock you off course. It’s about building resilience into your business DNA so you can adapt, recover, and move forward — faster and smarter.

When you embed mitigation into a solid Risk Reduction Program, your team moves from reacting to anticipating. You’re no longer scrambling after things go wrong; instead, you’re preparing for them before they happen.

“Risk mitigation doesn’t stop risk from existing. It empowers you to handle it better than your competitors.”

Now that you understand what risk mitigation truly means and why it matters, let’s explore the four core strategies that define every successful risk management plan.

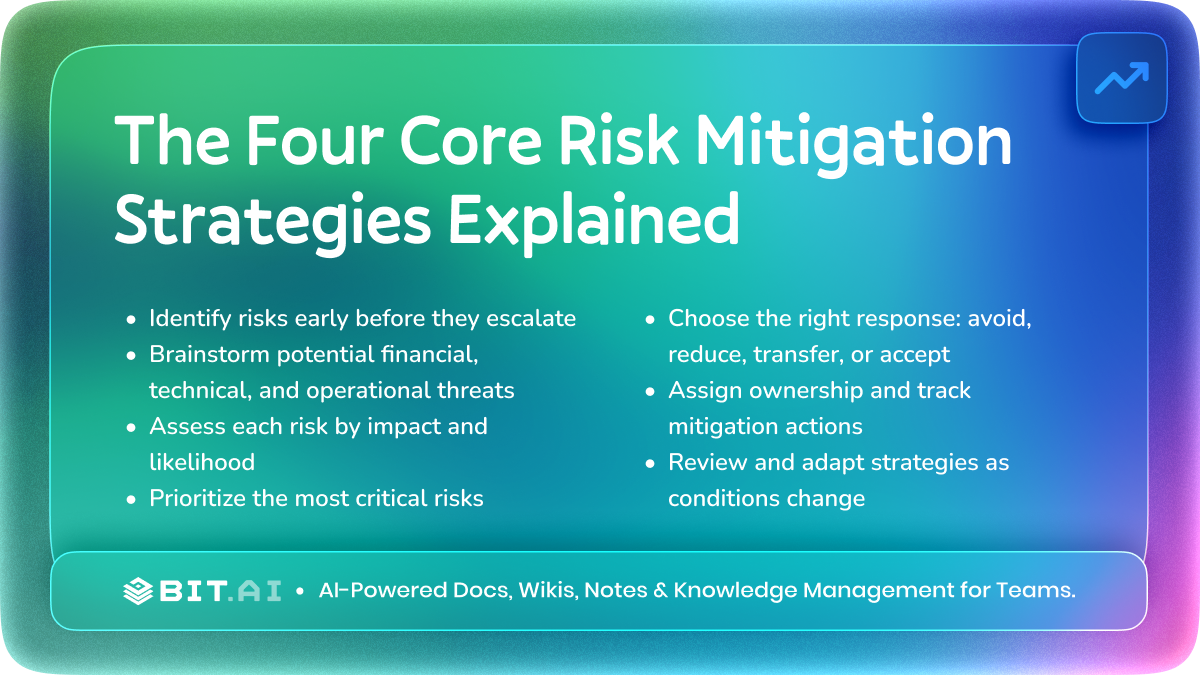

The Four Core Risk Mitigation Strategies Explained

Every organization faces uncertainty, but the smartest ones treat it like a chess match. Not something to fear, but something to understand and maneuver through. Risk is always on the board. The real question is whether you let it corner you or you learn how to play around it.

There is no perfect formula that magically removes all threats. What the best teams do is read the situation, assess the weight of each risk, and choose the smartest move. Most of those moves fall into four core strategies: Avoidance, Reduction, Transfer, and Acceptance.

Think of these as the four lenses you can look through before making any tough decision. Now let’s step into each one, almost like we are moving scene by scene.

1. Risk Avoidance

Picture this. You are walking into a partnership meeting, everything looks promising, until you realize one clause forces you to expose customer data to a vendor with a shaky security history. You pause. You assess. And instead of pushing ahead for the sake of convenience, you choose to walk away.

That is risk avoidance.

It is not fear. It is discipline. It is the moment you say, “This cost is not worth the potential fallout.”

Companies use avoidance when the danger outweighs the reward. A healthcare company refusing to store sensitive patient data with an unverified third party. A fintech app deciding not to expand into a country with unstable regulatory policies. A startup choosing not to integrate a feature that could slow down performance or compromise data.

Avoidance is your clean exit. It keeps you away from avoidable storms.

2. Risk Reduction

If avoidance is stepping away from the cliff, reduction is building a stronger guardrail around it.

This is where organizations lean forward and take action to make risks smaller. Not disappear. Just smaller. Strong enough that even if something goes wrong, it won’t take the system down with it.

This can look like upgrading your security tools, adding two factor authentication, switching from a single supplier to multiple suppliers, running routine audits, setting stricter access controls, or training your team against phishing attacks.

Here is a simple example.

A company cannot avoid using cloud storage because it powers its entire product. But they can reduce the risk by encrypting all data, setting up automatic backups, and monitoring for suspicious activity.

Reduction is a strategy in motion. It is your shield. Your buffer. Your safety net.

3. Risk Transfer

Sometimes the smartest move is to share the pressure. Do not escape it. Don’t minimize it. Just pass a portion of it to someone designed to handle that kind of pressure better than you.

That is risk transfer.

Think of insurance. Think of outsourcing. Think of partnering with a specialist vendor instead of building everything alone.

A cybersecurity firm may insure itself against data breach liabilities. A software company may outsource penetration testing to a specialized agency. A logistics business may partner with a third-party delivery network instead of handling every shipment internally.

You are not running away from responsibility. You are distributing it. You pick partners who match your standards, share your values, and have the expertise to manage what you cannot afford to mishandle.

This strategy is all about smart collaboration.

4. Risk Acceptance

Now we enter the final category. The quiet one. The one most people misunderstand.

Risk acceptance is not negligence. It is intentional. It is about choosing your battles wisely.

Not every risk deserves a five-thousand-dollar solution. Sometimes the impact is small. Sometimes the probability is low. Sometimes the mitigation cost is higher than the problem itself.

Imagine a software glitch that affects one in ten thousand users and causes nothing more than a minor UI freeze. You track it. You monitor it. But you don’t restructure your entire system because of it.

Acceptance is acknowledging the risk, staying aware, and keeping a contingency plan ready. It is maturity. The moment when you say, “We see the risk. We can live with it. We are prepared if things change.”

Need to safeguard against operational risks? Document your transition plan with this Free Transition Plan template.

Each of these strategies helps you take control of uncertainty instead of reacting to it. When implemented together, they create a system that keeps your organization steady even when the environment isn’t.

And that brings us to the next big question — how do you actually apply these strategies in a real-world setup? Let’s explore that next.

How to Identify and Apply Risk Mitigation Strategies

Picture this.

You’re leading a big project — deadlines are tight, budget is tighter — when suddenly, a supplier misses delivery. One tiny delay sets off a domino effect across teams. Emails flood in. Meetings pile up. Stress spikes.

Sounds familiar? That’s what happens when risk isn’t identified early enough.

The truth is, risks rarely come knocking. They sneak in quietly — through small oversights, outdated systems, or missing communication links. And before you know it, what looked like a minor glitch turns into a full-blown disruption.

So how do you make sure that doesn’t happen to you?

By learning to spot risks before they grow and applying strategies that turn panic into preparedness.

By learning to spot risks before they grow and applying strategies that turn panic into preparedness.

Here’s how you can start: 👇

Step 1: Spot What Could Go Wrong

Get your team together and think about all the things that could go wrong – like money problems, tech breaking down, data getting stolen, not following the rules, or issues with getting supplies. You’re not trying to guess the future; you’re just trying to be ready for it.

Step 2: Weigh the Impact

Not every problem is a big deal. Some might be minor, but others could really mess things up for you. Use a simple Risk Assessment Matrix to judge what’s most critical and focus your energy where it matters most.

Step 3: Pick Your Strategy

Once you know the threat, decide how to deal with it.

- Avoid what’s too risky.

- Reduce what’s manageable.

- Transfer what can be shared.

- Accept what’s small enough to live with.

It’s not about fear — it’s about foresight.

Step 4: Act, Track, and Adapt

Time to put your plans into motion. Give people jobs, set dates, and keep an eye on how things turn out. Then, do it all again. Things change, so your plans should too. What worked before might not work later – being able to change is super important.

Pro Tip: The best mitigation systems are alive. Keep your risk logs and assessments collaborative and dynamic so everyone can contribute updates in real time. A risk ignored by one team can snowball into a company-wide issue tomorrow.

When you start treating risk like a shared language, something shifts. Teams stop playing the blame game and start playing defense — together.

And that’s where modern tools make all the difference.

Because with the right digital workspace, you can map, document, and manage every risk in one place — in real time.

Let’s talk about that next.

Bonus Tool – Bit.ai: Your Hub for Risk Mitigation Planning

AI-powered docs, wikis, and knowledge management platform built for teams that want to plan smarter, collaborate faster, and mitigate risks together — all in one place.

Imagine your risk documentation isn’t scattered across folders or hidden in forgotten spreadsheets. Instead, everything — from your risk registers to mitigation plans and assessment matrices — lives in one beautifully organized workspace that your entire team can access and update in real time.

That’s where Bit.ai steps in.

It transforms the chaotic process of tracking risk into an effortless, collaborative experience and provides your organization with the structure, transparency, and agility to help deal with uncertainty like a pro.

It transforms the chaotic process of tracking risk into an effortless, collaborative experience and provides your organization with the structure, transparency, and agility to help deal with uncertainty like a pro.

Here’s how Bit.ai allows you to elevate your risk mitigation strategy 👇

- Centralized Risk Documentation

Keep all your risk-related data — assessments, reduction plans, and contingency outlines — in one collaborative digital workspace. Everyone sees the latest version, and nothing slips through the cracks.

- Real-Time Collaboration

Teams can co-edit documents, comment inline, and embed visuals or performance data to keep every stakeholder aligned. Say goodbye to version issues or slow updates during vital risk discussions.

- Live Embeds and Dashboards

Insert your charts, tables, and reports into Bit.ai documents right away. See the impact of risks, the status of mitigations, and the risks to mitigate in different sectors – live.

- Role-Based Access Control

Manage sensitive data with confidence. Set access permissions to ensure compliance while maintaining team transparency where it matters.

- AI Genius Writer

Bit.ai’s built-in AI Genius Writer helps you instantly draft, summarize, or rewrite sections of your risk management documentation. Need a mitigation plan summary or risk reduction report? Just ask the AI — and it’s ready in seconds.

- Version History & Audit Trail

Track every edit, update, and change in your risk registers or documentation. Whether you’re conducting an internal audit or reviewing team decisions, you’ll always have a clear record of who did what — and when.

Pro Tip: Use Bit.ai to create a shared “Risk Command Center.” Combine your registers, AI-generated summaries, assessment matrices, and dashboards in one collaborative doc. It not only saves time but also gives leadership a real-time view of every mitigation effort happening across the organization.

Pricing:

Bit.ai offers a free plan for small teams to get started. For advanced functionality — including AI Genius Writer, analytics, and custom branding — explore the Pro and Business plans, starting at just a few dollars per user per month.

Bit.ai isn’t just a platform — it’s your risk management ecosystem. With it, your team moves beyond reactive firefighting to a proactive, data-driven approach to risk mitigation.

Up next, let’s take a wider look at how different industries tackle risk — and why understanding sector-specific mitigation factors can make or break your strategy.

Bit.ai Risk Mitigation Template and Resources:

Below are some ready to use resources and templates that show how bit.ai can be used to effectively manage and mitigate risk.

Get Access to this Mitigation Plan for FREE!

Bit.ai is the ultimate AI-powered platform for creating professional documents and wikis tailored for various business needs.

Sector-Wise Factors that Influence Risk Mitigation

No two industries experience risk in the same way.

A storm that disrupts shipping routes might shake a manufacturer but barely scratch a fintech firm. A data leak could devastate a hospital but mean nothing to a farm. That’s the beauty and the challenge of risk mitigation — it’s universal, but it’s never identical.

In order to build resilience, it is necessary to understand what risk appears, feels, and behaves like in your industry. Let’s skim over some of the world’s most risk-sensitive industries.

1. Finance and Banking

Simply put, risk is the game when it comes to finance. The market opens and closes every second, regulations change overnight, and one terrible trade can have a domino effect across continents. For financial institutions, risk mitigation isn’t just about protection — it’s about precision.

They rely on real-time analytics, cybersecurity firewalls, and strict compliance frameworks to keep volatility under control. Every decision, every dataset, every transaction is measured against the potential of loss. The faster the detection, the smaller the damage.

2. Technology and IT Services

In tech, even a few seconds of downtime can be a huge problem. A tiny mistake can mess up everything, make customers lose trust, and end up costing a ton of money. And as we’re all more connected globally, these risks keep growing, from cyberattacks to systems just crashing.

Here, risk mitigation means more than protection; it means preparation. System redundancy, AI-driven monitoring, and zero-trust security protocols are key. The goal is to make systems that recover as fast as they fail — and sometimes, even faster.

3. Manufacturing and Supply Chain

Imagine a production line coming to a stop because one supplier did not deliver on time. Just one delay, and hundreds of people are standing around not working, with thousands of dollars lost every hour. In manufacturing, every component is vital — and one component can cause a chain reaction of delays.

That’s why the world’s best manufacturing firms rely on supplier diversification, digital twins, and real-time logistics dashboards. With predictive analytics, they can see bottlenecks before they happen and pivot instantly.

4. Healthcare and Life Sciences

Few industries face higher stakes than healthcare. A single oversight can cost more than money — it can cost lives. That’s why risk mitigation here focuses on data privacy, patient safety, and regulatory compliance.

Hospitals and pharmaceutical companies use documented workflows, traceable audit trails, and secure knowledge management platforms to ensure precision in every step — from patient diagnosis to drug development.

Every sector faces its own storm, but the principle remains the same — predict, prepare, and prevent. Whether it’s data, materials, or human lives at stake, the strength of your response defines your success.

Pro Tip: Don’t just track your supply chain — simulate it. Use digital mapping tools to visualize every moving part. If one supplier fails, your team already knows the next move.

Now that you’ve seen how risk mitigation varies across industries, let’s tie it all together. In the final section, we’ll wrap up everything we’ve learned — and explore how to make risk management a continuous, culture-driven process within your organization.

Wrapping Up

Risks will always exist — but how you prepare for them defines how strong your organization truly is.

Every business, no matter its size or sector, faces moments of uncertainty. A sudden market shift, a data leak, a missed deadline — these things happen. But when you have a strong risk mitigation strategy, you don’t just survive them… you grow through them.

Risk mitigation isn’t a one-time project you check off a list. It’s a living, breathing process that evolves with your business. It’s the way your team learns to stay calm in chaos, adapt faster, and keep pushing forward while others freeze.

That’s why modern organizations don’t just manage risks — they document, collaborate, and communicate around them. And platforms like Bit.ai make that easier than ever. When your risk registers, dashboards, and strategies all live in one place, your business transforms from reactive to resilient.

Every risk is a story waiting to unfold — and your organization gets to decide how it ends: with panic, or with preparation.

So, as you move forward, remember this: risk will always knock, but preparation decides whether it gets inside.

FAQs

- How do you identify and mitigate risks?

Start by spotting what could go wrong — financial, operational, or technical. Then assess how likely it is to happen and how severe its impact could be. Once you’ve mapped that out, apply the right mix of strategies: avoid, reduce, transfer, or accept the risk. Keep your process collaborative and data-driven using tools that allow visibility and real-time updates across teams.

- Why is a risk mitigation strategy important for business continuity?

Because even one unmitigated risk can disrupt everything — from operations to customer trust. A solid mitigation plan ensures your business stays steady during uncertainty. It helps you prepare, not panic, and maintain momentum no matter what challenges appear.

- What are the four risk mitigation strategies?

The four main approaches are:

- Avoidance: Eliminating activities that create exposure.

- Reduction: Minimizing the chance or impact of risks.

- Transfer: Sharing the risk with another party (like insurance or outsourcing).

- Acceptance: Acknowledging minor risks while staying prepared.

Together, they form the foundation of every strong risk management system.

- What steps are used to identify and mitigate risks?

The process usually includes: identifying risks, assessing their severity, prioritizing them, selecting mitigation techniques, and tracking results over time. It’s not a one-time task — it’s an ongoing cycle that strengthens with experience, communication, and technology.

- What’s the difference between risk mitigation and risk management?

Think of risk management as the big picture — identifying, assessing, and monitoring all possible threats. Risk mitigation is the action phase, where you actually implement solutions to reduce those threats. Management is the strategy, mitigation is the execution. Both are essential for long-term success